New Financial Year 2022/23: What You Need To Know

Published:

The start of the new financial year is fast approaching on 6th April 2022. We are set to see fewer changes compared to 2021/22, when changes set by HMRC were largely due to the instability caused by Covid-19. But what do you need to know ahead of the upcoming fiscal year? We have compiled the headlines, key dates and changes so you are prepared for the year start.

When do I need to file my tax return?

It has been reported that with just a few days to go until the 31st January tax return deadline, 3.5 million UK taxpayers are still yet to file a return. This is an increase from this time last year, when just over 26% of self-assessed taxpayers had yet to file.

However, this year a months grace period has been implemented. HM Revenue & Customs have waived the usual £100 late payment penalty as long as taxpayers file their returns and pay any tax owed by the end of February. So for small business owners and the self-employed – you still have time yet!

For further information visit HMRC’s designated Youtube channel.

So, what’s changing in the new financial year?

National Insurance

NI rates are set to rise by 1.25% from 6 April 2022. There are also some changes to the NI thresholds, with lower earning limits increasing by 3.1% and upper limits set to freeze at £50,270.

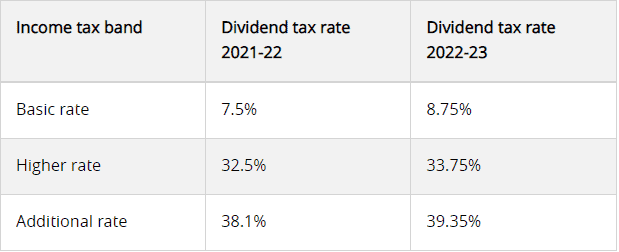

Dividend Tax

For those who earn through dividends – expect to see a 1.25% rise in the new year. The below table by Which? outlines the changes:

Capital Gains Tax Reporting

For anyone who makes capital gains from selling a property (a second home or buy-to-let), the window to report and pay the tax owed has been changed to 60 days from 30. Although, this has already been in effect since October 2021.

Inheritance Tax

A change that has again, already come into effect, is around what can be classed as an excepted estate (i.e. an estate where no inheritance tax needs to be paid).

For an estate to be classed as excepted from January 1st 2022, it needs to:

- Be valued below the inheritance tax threshold

- Be worth £650,000 or less and unused threshold to be transferred from a spouse or civil partner who died first

- Be worth <£3m and the deceased left everything in their estate to their surviving spouse or civil partner who lives in the UK, or to a registered UK charity

- Have UK assets worth <£150,000 and the deceased had permanently been living outside of the UK when they died

Other upcoming changes

Like many industries, accountancy is on a trajectory for digital transformation. In the UK, a new digital tax system named ‘Making Tax Digital for Income Tax’ is due to be rolled out in the 2024 new financial year. The system will be compulsory for the 4.3m self-employed tax payers, including landlords, and will mean that all expenses and earnings will have to be digitally recorded and filed every quarter.

In theory, it makes good sense. But the trial of this new system currently has only 9 volunteers taking part this year. Concerns are therefore being raised across the industry around the legitimacy of the software.

Signable and J. Williams

For accountants, it could seem as if digitalisation will inevitably lead to fewer jobs. But many actually believe the opposite – that technology will enhance accountants performance.

Signable is a good example of how accountants can benefit from enhancing digital processes. J. Williams are a busy accountancy firm offering a range of services and have used Signable for several years to make the service they provide their clients smoother. It was important to them that not only the office admin was streamlined, but that clients are also given an easier experience by saving their time and accommodating their schedules. Read more on how Signable helps J. Williams.

Signable offers a range of monthly plans to match your needs. Check them out here and start your 14 day free trial today.