The World Bank champions electronic signatures: A milestone for digital transformation

Published:

New World Bank policy note declares eSignatures essential

There’s been some big news in the world of electronic signatures and we’re excited to shine a spotlight on it! The World Bank’s latest policy note, Electronic Signatures: Enabling Trusted Digital Transformation, officially recognises electronic signatures as “essential infrastructure for digital economies.”

Now while we at Signable have been championing this view for a long time (forever), an endorsement of this scale positioning eSignatures as a key tool for making online transactions safe, smooth, and scalable, could be just the boost the industry has been waiting for!

The key points at a glance

The policy note identifies trust as being at the heart of every transaction. Traditionally, handwritten signatures have served this purpose, but as the world moves online, electronic signatures have stepped up as the new heroes of trust. They prove who you are, keep your data safe, and make sure everything’s legally sound – letting you seal the deal online without any hiccups in security or legitimacy.

The World Bank’s policy note outlines three critical elements for understanding the role of electronic signatures in digital economies:

1. Four pillars of electronic signatures

Electronic signatures support trust in digital transactions through four essential functions:

- Identification of the signer: Ensures the signer’s identity is clearly established.

- Attribution of the signature: Links the signature explicitly to the signer.

- Recording of intent: Confirms the signer’s deliberate action to approve the transaction.

- Assurance of data integrity: Protects the signed data from tampering.

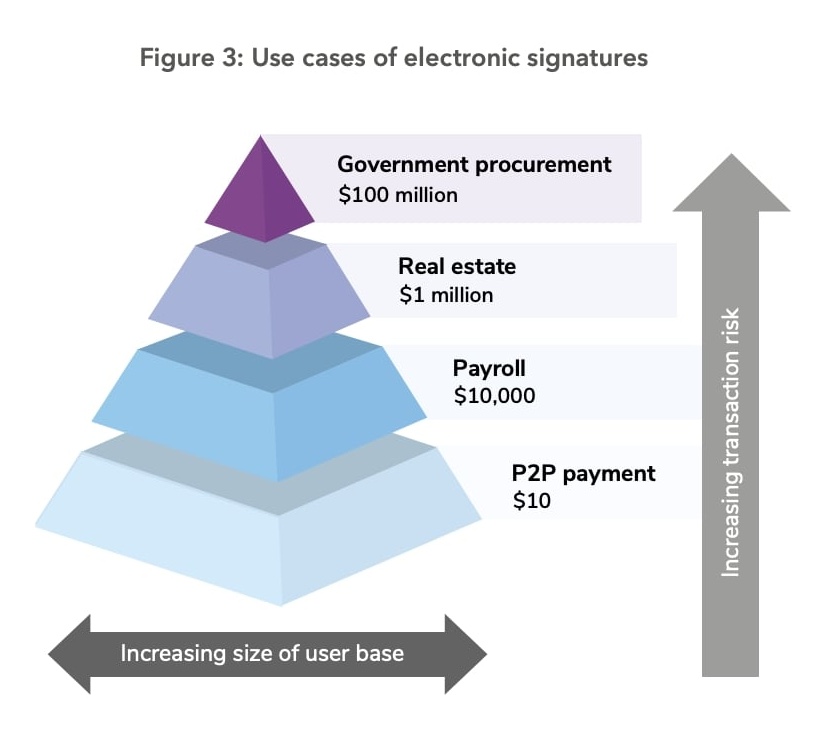

2. Tailored trust levels

Not all transactions carry the same level of risk, so the policy advocates for a risk-based approach:

- Low-risk transactions: This could be sending your friends or family a small amount of money. These types of transactions may use simple digital approvals like a PIN.

- High-risk transactions: Think real estate purchases or a government procurement. These transactions require advanced methods such as qualified digital signatures which include a digital certificate issued by a trusted party.

This flexible model allows electronic signatures to adapt to various needs without overburdening simpler processes.

*Source: World Bank Policy Report

3. Legal equivalence

One of the standout recommendations is the push for legal frameworks that treat electronic signatures on par with handwritten ones. This legal recognition makes it easier for individuals and businesses alike to use eSignatures and ensures they’re recognised across borders, which is vital for international transactions.

What does this mean for the future?

The World Bank’s emphasis on electronic signatures signals a shift towards inclusive, digital systems that work well together and are resilient. This momentum aligns with the anticipated rollout of eIDAS 2.0, the EU’s updated regulation on electronic identification and trust services.

eIDAS 2.0 is designed to build trust and make digital transactions easier across borders, both within the EU and beyond. It sets higher standards for verifying identities and using electronic signatures, creating a secure and easy-to-use system for online interactions. By aligning global policies with regional rules like eIDAS 2.0, it marks a new step toward international cooperation and recognition of trusted digital services.

Why it matters

For businesses and governments, switching to electronic signatures isn’t just about making things easier – it’s about working smarter, saving money, and sparking innovation. By cutting out the need for in-person verification, organisations can speed up their processes, lower their carbon footprint, and offer a better experience for users.

At Signable, we’re excited to be part of this global transformation. Our mission is to empower organisations with simple, secure, and legally compliant electronic signature solutions that align with international standards like eIDAS.

As the world embraces digital trust frameworks, the future is bright for digital economies, and we’re here to help you navigate it seamlessly. Interested in exploring how Signable can support your business? Sign up for a 14 day free trial today!

Get started in under 60 seconds

Check out our free 14 day trial and start sending documents now.